Page 14 - The Riverside Residence V2

P. 14

NISASIRI GROUP

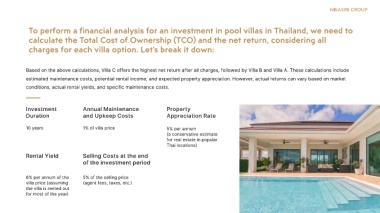

To perform a financial analysis for an investment in pool villas in Thailand, we need to

calculate the Total Cost of Ownership (TCO) and the net return, considering all

charges for each villa option. Let's break it down:

Based on the above calculations, Villa C offers the highest net return after all charges, followed by Villa B and Villa A. These calculations include

estimated maintenance costs, potential rental income, and expected property appreciation. However, actual returns can vary based on market

conditions, actual rental yields, and specific maintenance costs.

Investment Annual Maintenance Property

Duration and Upkeep Costs Appreciation Rate

10 years 1% of villa price 5% per annum

(a conservative estimate

for real estate in popular

Thai locations)

Rental Yield Selling Costs at the end

of the investment period

6% per annum of the 5% of the selling price

villa price (assuming (agent fees, taxes, etc.)

the villa is rented out

for most of the year)